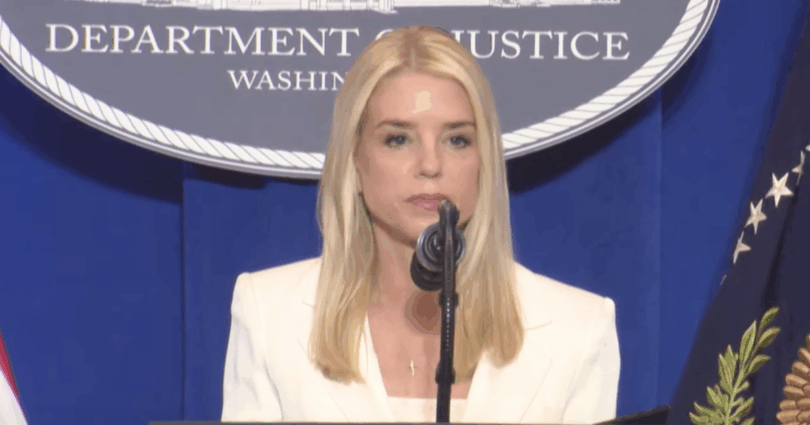

Pam Bondi Sold $1 Million of TMTG Shares on ‘Liberation Day’

Attorney General Pam Bondi sold at least $1 million worth of shares in Trump Media and Technology Group (TMTG) on April 2, 2025, the same day President Donald Trump announced sweeping global tariffs, a move he dubbed “Liberation Day.”

This announcement led to significant market volatility, with TMTG’s stock price dropping from over $20 per share on April 1 to $16.66 by April 8, before rebounding. Bondi’s sale, disclosed in official filings, has raised questions about the timing of the transaction and potential conflicts of interest.

Bondi’s stake in TMTG was valued between $1 million and $5.5 million at the time of the sale. She had previously agreed to divest all TMTG shares within 90 days of her confirmation as Attorney General, which would have been by early May.

The sale occurred just before the market reacted to the tariff announcement, leading to scrutiny over whether Bondi had advance knowledge of the policy change.

Democratic lawmakers have expressed concern over the timing of Bondi’s sale. Representative Greg Casar of Texas called for an investigation into potential insider trading, suggesting that the sale may have been influenced by non-public information about the tariff announcement.

While there is no direct evidence that Bondi had prior knowledge, the proximity of the sale to the policy announcement has fueled speculation.

The Trump administration’s tariff policy has been controversial, with critics arguing that the fluctuating announcements create opportunities for market manipulation, according to CBS News.

California Sen. Adam Schiff (D) highlighted the risks of such policy swings, suggesting they could benefit insiders who are privy to forthcoming changes.

The Justice Department has not commented on the matter, and it remains unclear whether Bondi’s sale was influenced by the tariff announcement.

Bondi’s financial dealings have been under scrutiny since her appointment. In December 2024, she disclosed that her TMTG holdings were worth over $3.9 million, which she received as compensation for consulting services.

Her role in the company’s merger with Digital World Acquisition Corp., a special purpose acquisition company, has also drawn attention. Bondi was listed as a consultant on the deal, which led to her acquiring shares in TMTG.

The timing of Bondi’s sale coincided with a broader market reaction to the tariff announcement.

While TMTG’s stock price fell initially, it has since rebounded, closing at $26 per share.

The company’s financial performance has been mixed, reporting a loss of $400.9 million in 2024 and a 12% decline in annual revenue to $3.6 million.

The company attributes the revenue decline to a change in a revenue-sharing agreement with an advertising partner, though the details remain undisclosed.

President Trump transferred all of his shares in TMTG, valued at around $4 billion, to the Donald J. Trump Revocable Trust in December 2024. His son, Donald Trump Jr., serves as the sole trustee and has sole voting and investment power over all securities owned by the trust.

Trump created Truth Social after being banned from X and Facebook following the January 6, 2021, Capitol protests. He has since been reinstated to both platforms.

The controversy surrounding Bondi’s sale highlights ongoing concerns about potential conflicts of interest within the Trump administration.

Critics argue that such transactions, especially when timed around significant policy announcements, can undermine public trust in government officials and their financial dealings.

While there is no definitive evidence that Pam Bondi’s sale of TMTG shares was influenced by prior knowledge of the tariff announcement, the timing of the transaction has raised questions about potential conflicts of interest and insider trading, per CBS News.

Continue Scrolling for the Comments

Leave a Comment